Advertisement

-

Published Date

July 19, 2023This ad was originally published on this date and may contain an offer that is no longer valid. To learn more about this business and its most recent offers, click here.

Ad Text

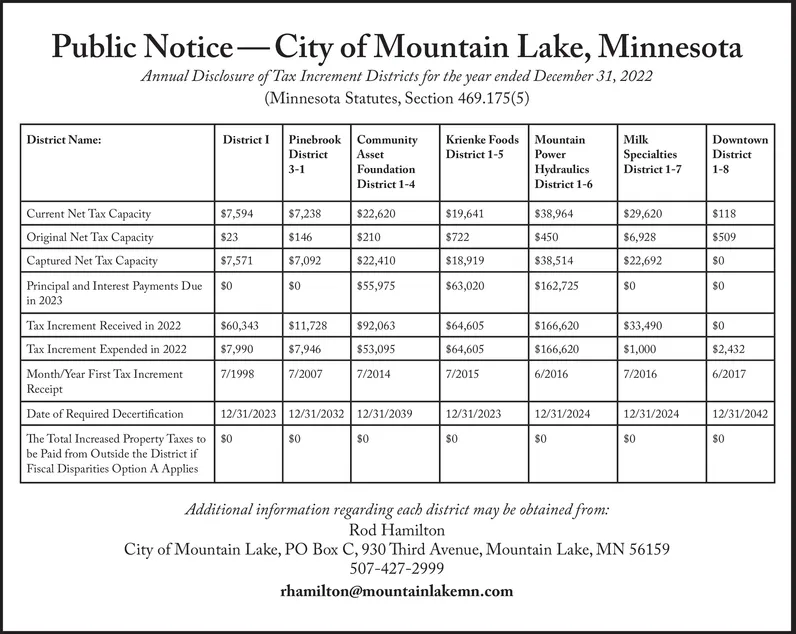

Public Notice City of Mountain Lake, Minnesota Annual Disclosure of Tax Increment Districts for the year ended December 31, 2022 (Minnesota Statutes, Section 469.175(5) District Name: Current Net Tax Capacity Original Net Tax Capacity Captured Net Tax Capacity Principal and Interest Payments Due in 2023 Tax Increment Received in 2022 Tax Increment Expended in 2022 Month/Year First Tax Increment Receipt Date of Required Decertification The Total Increased Property Taxes to be Paid from Outside the District if Fiscal Disparities Option A Applies District I $7,594 $23 $7,571 $0 $60,343 $7,990 7/1998 Pinebrook Community District Asset 3-1 $0 $7,238 $146 $7,092 $0 $11,728 $7,946 7/2007 Foundation District 1-4 $0 $22,620 $210 $22,410 $55,975 12/31/2023 12/31/2032 12/31/2039 $92,063 $53,095 7/2014 $0 Krienke Foods Mountain District 1-5 Power $19,641 $722 $18,919 $63,020 $64,605 $64,605 7/2015 12/31/2023 $0 Hydraulics District 1-6 $38,964 $450 $38,514 $162,725 $166,620 $166,620 6/2016 Milk Specialties District 1-7 $0 $29,620 $6,928 $22,692 $0 $33,490 $1,000 7/2016 12/31/2024 12/31/2024 $0 Additional information regarding each district may be obtained from: Rod Hamilton City of Mountain Lake, PO Box C, 930 Third Avenue, Mountain Lake, MN 56159 507-427-2999 rhamilton@mountainlakemn.com Downtown District 1-8 $118 $509 $0 $0 $0 $2,432 6/2017 12/31/2042 $0 Public Notice City of Mountain Lake , Minnesota Annual Disclosure of Tax Increment Districts for the year ended December 31 , 2022 ( Minnesota Statutes , Section 469.175 ( 5 ) District Name : Current Net Tax Capacity Original Net Tax Capacity Captured Net Tax Capacity Principal and Interest Payments Due in 2023 Tax Increment Received in 2022 Tax Increment Expended in 2022 Month / Year First Tax Increment Receipt Date of Required Decertification The Total Increased Property Taxes to be Paid from Outside the District if Fiscal Disparities Option A Applies District I $ 7,594 $ 23 $ 7,571 $ 0 $ 60,343 $ 7,990 7/1998 Pinebrook Community District Asset 3-1 $ 0 $ 7,238 $ 146 $ 7,092 $ 0 $ 11,728 $ 7,946 7/2007 Foundation District 1-4 $ 0 $ 22,620 $ 210 $ 22,410 $ 55,975 12/31/2023 12/31/2032 12/31/2039 $ 92,063 $ 53,095 7/2014 $ 0 Krienke Foods Mountain District 1-5 Power $ 19,641 $ 722 $ 18,919 $ 63,020 $ 64,605 $ 64,605 7/2015 12/31/2023 $ 0 Hydraulics District 1-6 $ 38,964 $ 450 $ 38,514 $ 162,725 $ 166,620 $ 166,620 6/2016 Milk Specialties District 1-7 $ 0 $ 29,620 $ 6,928 $ 22,692 $ 0 $ 33,490 $ 1,000 7/2016 12/31/2024 12/31/2024 $ 0 Additional information regarding each district may be obtained from : Rod Hamilton City of Mountain Lake , PO Box C , 930 Third Avenue , Mountain Lake , MN 56159 507-427-2999 rhamilton@mountainlakemn.com Downtown District 1-8 $ 118 $ 509 $ 0 $ 0 $ 0 $ 2,432 6/2017 12/31/2042 $ 0